Does a Background Check Affect Your Credit Score?

- Blog

- Credit Reporting Inaccuracies

Does a Background Check Affect Your Credit Score?

Everything seems to affect your credit score somehow. Does a background check? Find out if and how it might.

Background checks have become standard procedures when applying for a job or an apartment. Sometimes, a background check will include a credit check. When that happens, it shouldn’t affect your credit score. But sometimes things go awry. Find out how and why things go wrong and what you can do about it.

The background check attorneys at Consumer Attorneys receive many questions from people all around the country. One common question is: will a background check affect my credit score? It’s a very good question and it’s good to be aware of all the factors that might affect your credit score since so many things do.

The answer to the question like the answer to most legal questions is “it depends.” It depends on why the background check is being conducted and who is doing it. And of course it depends on the accuracy of the background check. While background checks should be accurate, and while the Fair Credit Reporting Act (FCRA) requires background check companies to use reasonable care to make them so, they are not always perfect and an imperfect one could hurt.

This article explains the relationship between background checks and credit scores, provides clear answers to common questions, and offers guidance on what to do if inaccuracies arise. If you have questions about background checks or if you have experienced a flawed background check that impacted your credit score, let us know.

What Is a Background Check?

A background check is a thorough investigation into a person’s history to assess their suitability for certain opportunities or responsibilities. Employers, landlords, and even some volunteer organizations often conduct background checks to verify the information applicants provide on their applications and to ensure there are no red flags or past events that indicate potential risk.

Main Types of Background Checks

Different entities will focus on and pay for different things, depending on where you want to live or for whom you want to work. Additionally, there are many background check companies, each offering a different fee structure for different plans that will include different information.

| Background Check Type | Description |

| Criminal background check | Investigates an individual's criminal record to uncover any past convictions or arrests. |

| Employment verification | Confirms past employment details, including job titles, duties, and dates of employment. |

| Education verification | Validates educational qualifications and degrees. |

| Credit check | Evaluates an individual’s credit history to gauge financial responsibility. |

| Driving record check | Looks at an individual's driving history for any infractions or accidents. |

| Identity verification | Ensures that the person is who they claim to be, often using Social Security numbers and other personal information. |

Does a Background Check Include a Credit Check?

Not all background checks include a credit check. However, some do, especially in industries where financial responsibility is critical, such as banking or financial management roles.

When a background check includes a credit report, it will show details such as:

- Existing credit accounts

- Existing loans

- History of credit accounts and loans (usually a seven-year history)

- Outstanding debts

- Account limits

- Payment history

- Hard credit inquiries (inquiries indicating you have applied for a loan or credit)

- Soft credit inquiries (inquiries into credit - like a background check)

- Bankruptcies

What is a Credit Score?

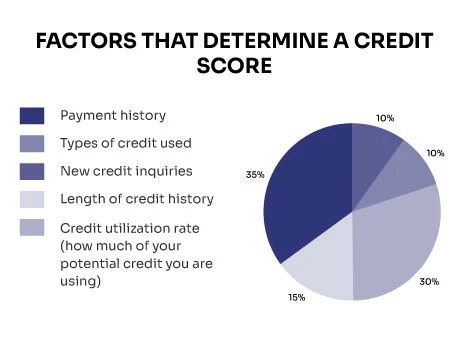

A credit score is a numerical representation of your creditworthiness, calculated based on your credit report. It usually ranges from 300 to 850, with higher scores indicating better credit health. Lenders use credit scores to assess the risk of lending money to a person.

A credit score is a numerical representation of your creditworthiness, calculated based on your credit report. It usually ranges from 300 to 850, with higher scores indicating better credit health. Lenders use credit scores to assess the risk of lending money to a person.

When Can You Expect to Get a Background Check?

You may undergo a background check in several situations:

- Job Applications. Many employers require background checks as a way to ensure they hire safe, trustworthy people.

- Employment. Some employers also periodically do background checks on their employees - this is especially true of drivers in the gig economy - during their employment to make sure nothing has changed.

- Rental Agreements. Landlords often do a background check on rental applicants.

- Loan Applications. Lenders often do background checks on people applying for a mortgage or personal loan.

- Licensing. Licensing authorities like state boards or professional organizations in fields like law, healthcare, and education, will often do background checks on licensing applicants.

How Background Check Errors Can Affect Your Credit Score

Background check errors can occur, and they can have severe consequences when they do. Common mistakes include incorrect criminal records, outdated information, or inaccuracies in credit reports.

Background Check Credit Score Impact

Incorrect information in a background check, especially if it includes a credit report, can lower your credit score. For example:

- Incorrect Debts. Mistakenly reported debts can increase your debt-to-income ratio, negatively affecting your credit score.

- False Late Payments. Inaccurate late payment records can severely damage your credit score.

Do Background Checks Hurt Your Credit Score?

Generally, a background check itself does not hurt your credit score. However, if the background check includes a credit inquiry, it depends on the type.

- Soft Inquiry. These do not affect your credit score and are typical for personal credit checks or employer background checks.

- Hard Inquiry. These can lower your credit score and usually occur when applying for credit, such as a mortgage or credit card.

Does Running a Background Check Affect Your Credit Score?

Running a background check that involves a soft inquiry will not impact your credit score. However, multiple hard inquiries in a short period can hurt your credit score, making it look like you're seeking a great deal of credit at once.

Addressing Background Check Errors

If you find errors in a background check that affect your credit score, take the following steps:

- Get a Copy of the Report. Request a copy of the background check and identify any inaccuracies.

- Seek Legal Assistance. If the issue persists, consult a background check attorney or a credit report attorney for further action. A background check attorney at Consumer Attorneys can dispute information on your behalf, work with reporting agencies to correct errors, and, if necessary, take legal action to get you the compensation you deserve if a background check error results in damages.

- File a Dispute with the Reporting Agency. Notify the background check company or credit bureau of the errors. Your attorney can help with this.

- Provide Documentation. Submit evidence that supports your claim, such as bank statements or court documents.

Most states have a look-back period of seven years. However some states have a 10-year look-back period. Check with a lawyer if you live in one of the 10-year background check states.

Conclusion

Understanding the interplay between background checks and credit scores is crucial for safeguarding your financial health. While background checks themselves do not usually affect your credit score, errors or credit inquiries associated with them can. If you encounter inaccuracies, promptly address them by contacting the relevant agencies and, if necessary, seek legal assistance from a consumer law firm like Consumer Attorneys.

Frequently Asked Questions

Employment background checks should not affect your credit score. An employer doing a background check may review your credit report, but this is considered a “soft inquiry” and does not impact your credit score. Unlike the “hard inquiries” lenders make when you apply for credit, soft inquiries do not lower your score; they just give employers an overview of your financial responsibility but are separate from the credit inquiries that influence your credit score.

Yes, you can “fail” a background check due to bad credit, depending on the job or apartment for which you’re applying. Employers, especially in finance or for roles requiring security clearance, may view poor credit as a sign of financial irresponsibility or an avenue by which you can be coerced. Significant debt, missed payments, or bankruptcy can raise concerns about your reliability and trustworthiness. However, not all employers consider credit history crucial, and they will usually assess your credit status alongside other factors if they assess it at all. It’s important to review your credit report and address any issues before you start looking for a new job to avoid any issues or at least be prepared to discuss them during the hiring or apartment application process if necessary.

A “complete discrepancy” on a background check means there is a significant inconsistency between the information the candidate provided the employer and the data found during the check. This can involve discrepancies in employment history, educational qualifications, criminal records, or other personal details. For example, if a candidate claims they have a degree from a particular or particularly prestigious university but the background check reveals no record of this degree, it would likely result in a complete discrepancy. Such inconsistencies can and do raise red flags for employers, leading to doubts about the candidate’s honesty and reliability, potentially affecting their chances of securing the job.

This is really up to the employer, though the Fair Credit Reporting Act (FCRA) does provide some guidance. If there is a discrepancy on a background check, the employer will likely review the conflicting information carefully. They may contact the job candidate to clarify or provide additional documentation. The nature and significance of the discrepancy will determine the next steps. Minor errors, such as incorrect dates, might be quickly resolved, while significant discrepancies, like falsified credentials or undisclosed criminal records, can lead to the withdrawal of the job offer. Transparency and prompt communication from the candidate can help address issues. Employers usually assess the potential impact of the discrepancy on job performance and trustworthiness before making a final decision. And even before they make a decision, they must send the candidate a notice they may take adverse action.

Yes, debt can show up on a background check if the employer includes a credit report as part of the screening process. This report provides information about your credit history, including outstanding debts, credit card balances, loans, and payment history. Employers may review this to assess financial responsibility and trustworthiness, especially in financial industries or positions requiring security clearance. However, not all background checks include a credit report, and those that do will show debt details but will not include your credit score. It’s vital to know your credit status and be prepared to discuss any issues if asked.

Daniel Cohen is the Founder of Consumer Attorneys. Daniel manages the firm’s branding, marketing, client intake and business development efforts. Since 2017, he is a member of the National Association of Consumer Advocates and the National Consumer Law Center. Mr. Cohen is a nationally-recognized practitioner of consumer protection law. He has a we... Read more

Related Articles

R

ONGS™You pay nothing. The law makes them pay.