The Ultimate Guide to the HireRight Background Check Errors: Time, Content and Your FCRA Rights

- Blog

- Employment Background Check Errors

The Ultimate Guide to the HireRight Background Check Errors: Time, Content and Your FCRA Rights

What HireRight Checks, Why Reports Get Delayed, and What the Law Requires When Errors Appear

At some point in nearly every hiring process, the same phrase arrives: "We're waiting on your background check." It's delivered casually, almost reassuringly, as though it were mere procedural housekeeping that will resolve itself while life moves forward. But when HireRight is involved, that supposed formality often becomes the most consequential step in the entire process, and the least transparent.

HireRight isn't simply verifying a fact or two. It's constructing a consumer report about you - one assembled from disparate data sources, maintained by different record custodians, and processed through layers of automation and human review. That report can determine whether an offer advances, whether a start date holds, or whether an opportunity vanishes without explanation. For many, the first indication of trouble isn't a rejection but silence. Days stretch into weeks. A vague update surfaces about "verification." And no one can seem to explain what, precisely, is happening.

If you're reading this, you're likely trying to understand what HireRight actually examines, how long the process should reasonably take, and what recourse you have when the information being reported is inaccurate. These aren't idle questions - they're legal ones. And they demand clear answers.

This guide walks through the HireRight background check process in detail: how it works, where it breaks, and what the law requires when it does.

In this article, you’ll learn:

- What Is a HireRight Background Check and Who Uses It?

- HireRight Background Check Time: How Long Does It Really Take?

- What Does HireRight Check?

- Your FCRA Rights During a HireRight Background Check

- Common HireRight Errors and Why They Happen (The FCRA Perspective)

- Dispute Mistakes on Your HireRight Background Check: How to Start the Correction

- When a HireRight Error Costs You a Job: Your Next Legal Steps

What Is a HireRight Background Check and Who Uses It?

HireRight is one of the largest background screening companies operating globally. Employers do not search court systems, verify past employment, or confirm educational records themselves. They outsource that work to companies like HireRight, which collect, assemble, and evaluate personal data in order to produce reports used in employment decisions.

Under the Fair Credit Reporting Act (FCRA), HireRight is classified as a consumer reporting agency. That designation matters. It means HireRight is legally responsible for the accuracy, handling, and reinvestigation of the information it reports. When HireRight prepares a background check, it is producing a consumer report that will be used to evaluate your eligibility for employment. That report is not advisory. It is not informal. It is often determinative.

What companies & employers use HireRight for background checks?

HireRight is widely used by large corporate employers, healthcare systems, logistics and transportation companies, financial institutions, government contractors, and national retail chains. It is also used in connection with federal and quasi-federal roles, including contractors associated with organizations such as USPS and GIS.

This scale matters. According to HireRight’s own public filings, the company conducts tens of millions of background checks each year across more than 200 countries and territories. At that volume, even a small error rate translates into a significant number of people affected.

This is not niche screening. This is high-volume, high-impact screening. And when HireRight makes a mistake, it does not stay small.

HireRight Background Check Time: How Long Does It Really Take?

“How long does a HireRight background check take?” is one of the most searched questions online, and one of the hardest to answer cleanly. You will see ranges. You will see averages. You will see optimistic timelines. None of them tell the full story.

In practice, a HireRight background check can take anywhere from a few business days to several weeks. The difference is driven by how much of your report requires manual data sourcing and how many third parties have to respond. A county court that does not offer electronic access, an employer with slow HR response times, or a school that verifies records only by mail can all stretch a timeline far beyond what anyone initially expects.

This is not speculation. The U.S. Government Accountability Office (GAO) has repeatedly noted that the accuracy and timeliness of background check data depend heavily on the quality and responsiveness of underlying record systems, many of which are outdated or under-resourced.

Factors affecting the duration (location, common names)

Some of the biggest factors that affect HireRight background check time include:

- county-level criminal searches in jurisdictions without electronic access,

- international records that require cross-border verification,

- multiple prior employers that must be contacted individually,

- schools that verify education slowly or only by mail,

- common names, which increase the risk of false matches and additional review.

Name-based matching is a particular vulnerability. When thousands of people share the same name, the system does not automatically know which record belongs to you. That uncertainty triggers additional review. It also increases the risk of mistaken identity.

And this is not a rare problem. The Federal Trade Commission (FTC) has found that one in five consumers has an error on at least one of their consumer reports.

Why HireRight background checks get delayed

Most delays are not caused by anything the applicant has done. They are usually the result of slow court clerks, unresponsive HR departments, records flagged for manual review, conflicting information across databases, or internal quality-control processes that are invisible to applicants.

What you experience is waiting. What is often happening is the system trying to reconcile incomplete or inconsistent data.

From a legal perspective, delays tied to unresolved or inaccurate information are not harmless. The FCRA requires consumer reporting agencies to follow reasonable procedures to assure maximum possible accuracy. When a report is stalled because the data cannot be confidently verified, accuracy is already in question.

Is HireRight background check faster or slower than Checkr and/or Sterling?

HireRight, Checkr, and Sterling operate at similar scale. All rely on a combination of automated database searches, human verification teams, and third-party data sources. Speed varies based on employer configuration and search scope. One is not inherently “better” than the other.

What matters far more than speed is this: a fast error is still an error. And under the law, accuracy comes first.

What Does HireRight Check?

When people ask what HireRight checks, they often imagine a single database scan. In reality, a HireRight background check is a layered process, built from multiple verifications that pull from different systems with different standards.

HireRight criminal background check (scope and time)

A HireRight criminal background check may include county, state, and federal searches, along with sex offender registry checks and, for some roles, global watchlist searches. These records are not stored in one unified national system. They are fragmented across jurisdictions, maintained at varying levels of quality, and updated at different speeds. That fragmentation is one of the main reasons mistakes happen.

The National Consumer Law Center has repeatedly warned that criminal background databases are often incomplete, inaccurate, and poorly maintained, leading to false positives and outdated information being reported.

It is not uncommon for someone else’s criminal record to appear because of a name match, for expunged or sealed cases to resurface because a database was not updated, or for dismissed charges to be reported without final disposition. These are not technicalities. They are inaccuracies that can directly affect employment decisions.

HireRight employment history verification

HireRight typically verifies employer names, dates of employment, and job titles. Problems arise when companies close, merge, change payroll providers, or simply fail to respond. In those situations, the report may come back as “unable to verify,” with incorrect dates, or with discrepancies that suggest misrepresentation.

To an employer, that can look like dishonesty. To the law, it can be inaccurate reporting.

And according to a CareerBuilder survey, 58% of employers report finding inaccuracies on résumés, which increases scrutiny on employment verification and raises the stakes when background screening companies get it wrong.

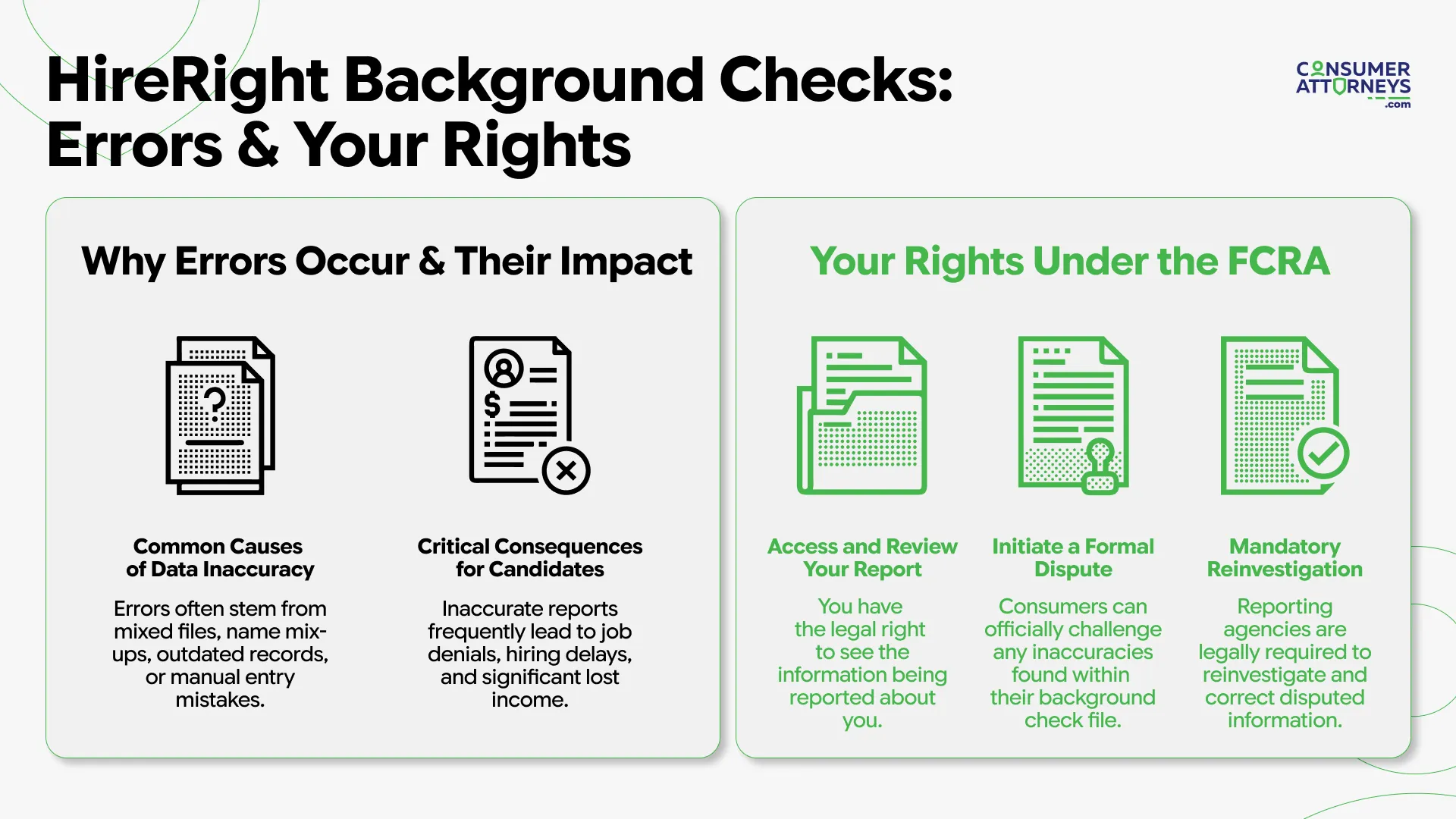

Your FCRA Rights During a HireRight Background Check

At this point, the legal framework becomes unavoidable.

Because HireRight is a consumer reporting agency, it is subject to the Fair Credit Reporting Act. That law exists to protect individuals when their personal information is used to make decisions about employment, credit, housing, and insurance. It is not a technicality. It is the backbone of your rights in this process.

Under 15 U.S.C. §1681e(b), HireRight is required to follow reasonable procedures to assure maximum possible accuracy of the information it reports. That means no careless data matching, no mixed files, and no reliance on obviously outdated information.

Courts have been clear that accuracy is not optional and not aspirational. It is a legal requirement.

If your HireRight background check contains inaccurate or incomplete information, you have the right under 15 U.S.C. §1681i to dispute it. That dispute triggers a legal obligation to conduct a reasonable reinvestigation and to correct or delete information that cannot be verified.

The Consumer Financial Protection Bureau (CFPB) has emphasized that investigations must be meaningful, not perfunctory.

If an employer takes adverse action, or is about to take adverse action, based on a HireRight report, you are entitled under 15 U.S.C. §1681b(b)(3) to receive a copy of the report and a summary of your rights. If you were never shown the report, that is not a courtesy issue. It is a compliance issue.

Common HireRight Errors and Why They Happen (The FCRA Perspective)

Most errors are not the result of bad intent. They are the result of scale. Systems built to process millions of records rely heavily on automation, name matching, and third-party data sources. Those tools are efficient. They are not precise.

HireRight mixed files and mistaken identity errors

Mixed files occur when records from two people are combined, often because of similar names or overlapping identifiers. Once that happens, the individual is effectively treated as someone they are not. Under the FCRA, that is a serious violation. Identity accuracy is foundational.

The FTC has repeatedly identified mixed files as a leading cause of consumer report inaccuracies.

Failure to update records (expunged charges)

Another common problem is the continued reporting of expunged, sealed, or reduced records. Once a case is expunged, it should not be reported. When it continues to appear, it is not just outdated - it is inaccurate.

The American Bar Association has documented persistent failures by data brokers and screening companies to properly update expunged records.

These errors do not announce themselves. They sit quietly in reports and do damage behind the scenes.

Dispute Mistakes on Your HireRight Background Check: How to Start the Correction

When HireRight reports inaccurate information, the law gives you the right to dispute it. But how you dispute matters. Structure matters. And precision matters.

This is not a situation where “click and hope” is an effective strategy.

Do not rely on employer summaries or status updates. Request the complete consumer report from HireRight directly, so you can see exactly what was reported and how it was presented. Mention the company the report was run for and the date. You should also mention that you were denied a job based on this report in particular, to speed up the delivery.

Be specific. Whether the issue is a mixed file, an incorrect disposition, an outdated case, or misattributed information, isolate the precise entry that is wrong.

Vague disputes are easier to dismiss.

Collect records that clearly show the information is inaccurate, such as:

- court documents reflecting dismissal, expungement, or reduction,

- identification documents if the record belongs to someone else,

- official records correcting employment or education history.

This is about evidence, not explanation.

Submit your dispute in writing and include your documentation. The goal is to create a clear, traceable record of what you challenged and why.

Avoid casual messages or unsupported claims.

Under the Fair Credit Reporting Act, HireRight is required to conduct a reasonable reinvestigation, generally within 30 days. Mark the date you submit and track the response.

Silence is not resolution.

If HireRight corrects or deletes the information, confirm that the change is reflected in the report. If the information remains and is still wrong, the issue may no longer be administrative.

When inaccurate reporting affects your income, housing, or employment opportunities, the situation moves beyond customer service. At that point, legal rights may be involved regardless of the outcome of the dispute.

When a HireRight Error Costs You a Job: Your Next Legal Steps

When an offer is rescinded, when a start date is pushed, or when an application is denied because of a HireRight report, and that report is wrong, the situation is no longer hypothetical. At that point, the issue is not frustration or inconvenience. It is harmful.

This is the stage where Consumer Attorneys typically becomes involved.

Our work in HireRight cases focuses on what the law actually requires and where the screening process failed. We investigate how the information was sourced, whether proper procedures were followed to assure accuracy, and whether HireRight conducted a meaningful reinvestigation after the error was raised. That includes examining mixed files, mistaken identity, outdated records, incomplete verifications, and failures to update expunged or sealed information.

We do not treat these cases as “background check problems.” We treat them as Fair Credit Reporting Act violations, because that is what they are when inaccurate reporting costs someone work, income, or opportunity.

In practical terms, our team helps by:

- obtaining and reviewing the full HireRight file, not just the summary report,

- identifying where the data came from and whether it was legally reportable,

- analyzing whether HireRight followed reasonable procedures to assure maximum possible accuracy,

- assessing whether the reinvestigation process was lawful and adequate,

- documenting the real-world impact of the error, including lost wages, rescinded offers, and emotional distress.

From there, we pursue correction of the record and accountability for the harm caused. In many cases, that means litigation. In others, it means forcing compliance and resolution through legal pressure.

The pattern is one we see often: qualified individuals, inaccurate reports, and opportunities lost because the system was confident but wrong. Our role is to step in at that point and make sure the law is enforced, not ignored.

Frequently Asked Questions

A prolonged “pending” status usually means HireRight is waiting on third-party verification, such as a court, school, or former employer. It often indicates that something cannot be immediately confirmed, not that you failed the check.

HireRight does not make hiring decisions. It supplies the report. The employer decides what to do with it. That said, employers often rely heavily on the report, which is why accuracy is critical.

Not always. Many applicants only learn there is an issue after an employer raises concerns or rescinds an offer. You are not guaranteed proactive notice from HireRight when something is wrong.

Self-employment and freelance work can be harder for HireRight to verify because there is no traditional HR department. In these cases, verification may depend on tax records, contracts, or other documentation, and “unable to verify” results are more common.

No. Each employer request is separate. HireRight does not maintain a universal “pass/fail” record on you, and one background check result should not automatically carry over to other applications.

Daniel Cohen is the Founder of Consumer Attorneys. Daniel manages the firm’s branding, marketing, client intake and business development efforts. Since 2017, he is a member of the National Association of Consumer Advocates and the National Consumer Law Center. Mr. Cohen is a nationally-recognized practitioner of consumer protection law. He has a we... Read more

Related Articles

R

ONGS™You pay nothing. The law makes them pay.