USPS Job Denied After a GIS or HireRight Background Check? Know Your FCRA Rights

- Blog

- Employment Background Check Errors

USPS Job Denied After a GIS or HireRight Background Check? Know Your FCRA Rights

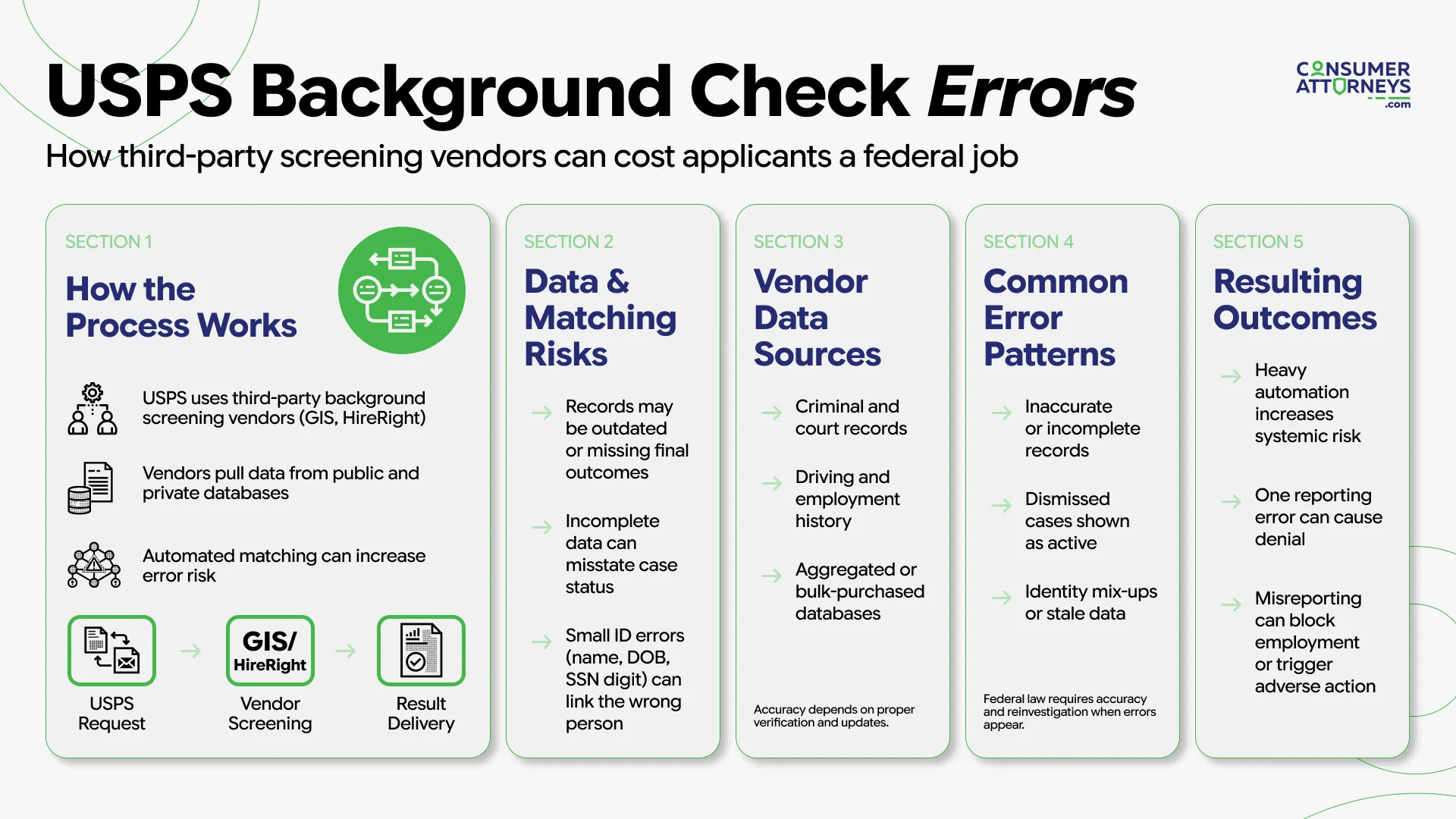

How GIS and HireRight Screening Errors Lead to USPS Job Denials and Trigger FCRA Protections

A position with the United States Postal Service is not just another job application. For many applicants, it represents long-term stability, federal benefits, and a career path that does not vanish with market volatility. That is precisely why a USPS denial carries unusual weight and why errors in a background check for USPS employment can cause outsized harm.

When a conditional offer is withdrawn after a background check USPS screening, applicants are often left with little explanation. The decision may be labeled “final,” with no clear description of what information triggered it or how to challenge the underlying data. For applicants denied due to inaccurate background reporting, this confusion is not merely frustrating - it may raise serious issues under the Fair Credit Reporting Act (FCRA).

This article explains how the USPS background check process works, where GIS and HireRight fit into that system, the most common reporting errors that derail qualified applicants, and what legal rights exist when inaccurate data blocks federal employment.

In this article, you’ll learn:

- Why the USPS background check process is different

- How GIS and HireRight are involved

- Common reasons qualified applicants are denied

- Your FCRA rights after a USPS denial

- Disputes, appeals, and when legal action may be appropriate

Why the USPS Background Check Process Is Different

USPS hiring uses a hybrid screening model.

In the early stages of hiring, USPS may obtain a criminal background check and, where applicable, a motor vehicle record (MVR) through a consumer reporting agency (CRA). This background check for USPS roles is used to assess suitability for employment. In addition, USPS conducts a more in-depth federal background investigation, commonly a National Agency Check with Inquiries (NACI), through the U.S. Postal Inspection Service.

This layered approach means some decisions are driven by commercial CRA reports, while others come from federal investigative screening. The rights and remedies depend on which one actually triggered the denial.

Unlike many private-sector employers, USPS hiring decisions are governed by formal federal procedures. While USPS states that candidates are evaluated individually, applicants often experience the process as rigid and opaque, particularly once a report flags a concern in a background check USPS review.

IMPORTANT:USPS may use (1) commercial background screening reports from consumer reporting agencies (CRAs) like GIS/HireRight, and (2) separate federal background investigations (such as NACI or other government records checks). The FCRA generally applies to commercial CRA reports used for employment decisions. It does not apply the same way to federal investigative checks that are not “consumer reports.” Consumer Attorneys can help when a commercial report is involved.

The Role of GIS and HireRight in USPS Hiring

Applicants frequently receive background check communications from General Information Services (GIS). In many cases, the initial GIS background check for USPS employment is the first screening layer an applicant encounters.

GIS is a background screening provider that merged under common ownership with HireRight in 2018 and now operates within the HireRight corporate structure.

Depending on the position and timing, applicants may encounter GIS branding, HireRight branding, or both. In this context, these companies function as consumer reporting agencies when they assemble and furnish background reports for employment purposes.

When a USPS hiring decision is influenced by information supplied by a CRA, that reporting is subject to the requirements of the FCRA, regardless of the fact that the employer is a federal agency.

Common Reasons for USPS Background Check Denials

Because USPS may also conduct separate federal screening outside of GIS/HireRight, not every “failed USPS background check” is an FCRA issue. Our focus is commercial consumer reports prepared by CRAs, like GIS/HireRight, used in employment decisions. In many cases involving a commercial background check, however, the issue is not the applicant’s actual history - it is how that history was reported.

Common Background Report Errors

We frequently see USPS denials tied to well-documented reporting problems in a background check USPS screening, including:

- Mixed files (records belonging to someone else with a similar name or identifiers),

- Dismissed or reduced charges reported as convictions,

- Expunged or sealed records that should not appear at all,

- Incomplete court records lacking final disposition,

- Outdated information that was never corrected across databases

These errors can easily become a red flag USPS background check issue, even when the applicant has done nothing wrong.

The U.S. Government Accountability Office has repeatedly documented systemic problems in criminal history record information, particularly missing or incomplete disposition data and fragmentation across jurisdictions. When incomplete records are used for employment screening, the risk of inaccurate conclusions increases significantly.

USPS Background Check Disqualifiers: What Actually Triggers Concern?

Many applicants search for USPS background check disqualifiers: There’s no official one-size-fits-all list. USPS says it considers each applicant individually, but the following issues tend to draw the most attention, including:

- Recent felony convictions related to theft, fraud, or violence,

- Unresolved criminal charges,

- Patterns of serious driving violations for roles requiring vehicle operation,

- Falsification or omission of material information in the application,

- Unresolved identity discrepancies or mismatched personal identifiers.

Importantly, a reported issue is not always a legitimate disqualifier. It may instead be the result of inaccurate or incomplete reporting.

Red Flags That Often Trigger USPS Background Check Denials

Many USPS applicants never receive a copy of the report that led to the denial. Instead, they are informed only that they did not clear the background check.

Common red flag USPS background check indicators in disputed cases include:

- Criminal records without a final outcome,

- Mismatched personal identifiers,

- Arrests reported as convictions,

- Records from jurisdictions the applicant has never lived in,

- Employment verification failures caused by data gaps.

To an automated system, these may appear as unresolved risks. Under the FCRA, they may constitute inaccurate or misleading reporting.

According to the National Employment Law Project, an estimated 70 million U.S. adults have some form of criminal record. Many of those records are incomplete, outdated, or misleading when reproduced in commercial databases, making accuracy especially critical in federal hiring pipelines.

Your Rights After a USPS Job Is Denied

A USPS denial does not eliminate your rights. In many cases, it is when your rights matter most. When GIS or HireRight furnishes a background report for employment purposes, the FCRA generally requires that the reporting agency:

- Follow reasonable procedures to assure maximum possible accuracy,

- Avoid reporting information that is misleading or legally non-reportable,

- Conduct a reasonable reinvestigation when disputed information is challenged.

These obligations apply even when the employer is a federal agency.

Disclosure and the Right to Review Your Report

If an employment decision is based in whole or in part on a consumer report, the employer (or the entity acting as the “user” of that report) must generally provide a pre-adverse action notice. This notice includes a copy of the report and a summary of the applicant’s rights under the FCRA, giving the applicant an opportunity to review and dispute inaccuracies before the decision becomes final.

Failure to provide proper disclosure may itself raise compliance concerns.

Disputes and the 30-Day Reinvestigation Rule

When inaccurate information is disputed, the FCRA generally requires a reporting agency to complete its reinvestigation within 30 days, with limited circumstances allowing a short extension.

In practice, many USPS applicants are never clearly told where to dispute, what information was reported, or how to correct it. Others are directed to generic portals without explanation. Meanwhile, federal positions may be filled before an error is resolved.

A dispute is an important step, but it is not always a complete solution.

Appealing a USPS Denial vs. Filing an FCRA Claim

Appealing a USPS hiring decision and pursuing an FCRA claim are not the same thing.

- An appeal asks the hiring system to reconsider its decision.

- An FCRA claim examines whether a consumer reporting agency violated federal law in producing or handling the report that caused the denial.

While USPS hiring decisions themselves may be governed by internal federal procedures, background screening vendors remain subject to the FCRA. When inaccurate reporting, unreasonable procedures, or deficient reinvestigations block employment, those vendors can be held accountable under federal law, even in the context of federal hiring.

At Consumer Attorneys, we examine USPS background check cases by asking:

- Where did the data originate?

- Was the information legally reportable?

- Were reasonable accuracy procedures followed?

- Was the reinvestigation conducted lawfully and in good faith?

These cases are not treated as “USPS disputes.” They are evaluated as potential FCRA violations when inaccurate data interferes with employment.

Many FCRA cases are handled on a contingency basis, and the law provides for recovery of attorney’s fees in certain successful actions.

Frequently Asked Questions

In practice, many applicants are never automatically given a copy of the GIS or HireRight report. However, if the denial was based on information in a consumer report, federal law requires that you be provided access to that report and a summary of your rights. A denial without proper disclosure may itself raise compliance concerns.

Yes. USPS background checks often involve deeper federal screening layers and multiple vendors working together. This complexity increases the likelihood of data mismatches, incomplete updates, and record-handling errors that are less common in private-sector hiring.

Not necessarily. “Final” usually refers to the USPS hiring decision, not your legal rights. If inaccurate information from GIS or HireRight influenced the denial, federal law may still provide a path to correction or legal action regardless of USPS internal terminology.

You may be able to reapply, but reapplication does not correct inaccurate background data. If the underlying error remains in your GIS or HireRight file, the same issue may trigger another denial. Correcting or legally addressing the reporting error is often necessary before reapplying.

No. Disputing inaccurate information is a protected right under the Fair Credit Reporting Act. A reporting agency may not retaliate or flag an applicant for asserting their legal rights. If inaccurate data continues to be reported after a dispute, that may strengthen, not weaken, a potential claim.

Daniel Cohen is the Founder of Consumer Attorneys. Daniel manages the firm’s branding, marketing, client intake and business development efforts. Since 2017, he is a member of the National Association of Consumer Advocates and the National Consumer Law Center. Mr. Cohen is a nationally-recognized practitioner of consumer protection law. He has a we... Read more

Related Articles

R

ONGS™You pay nothing. The law makes them pay.